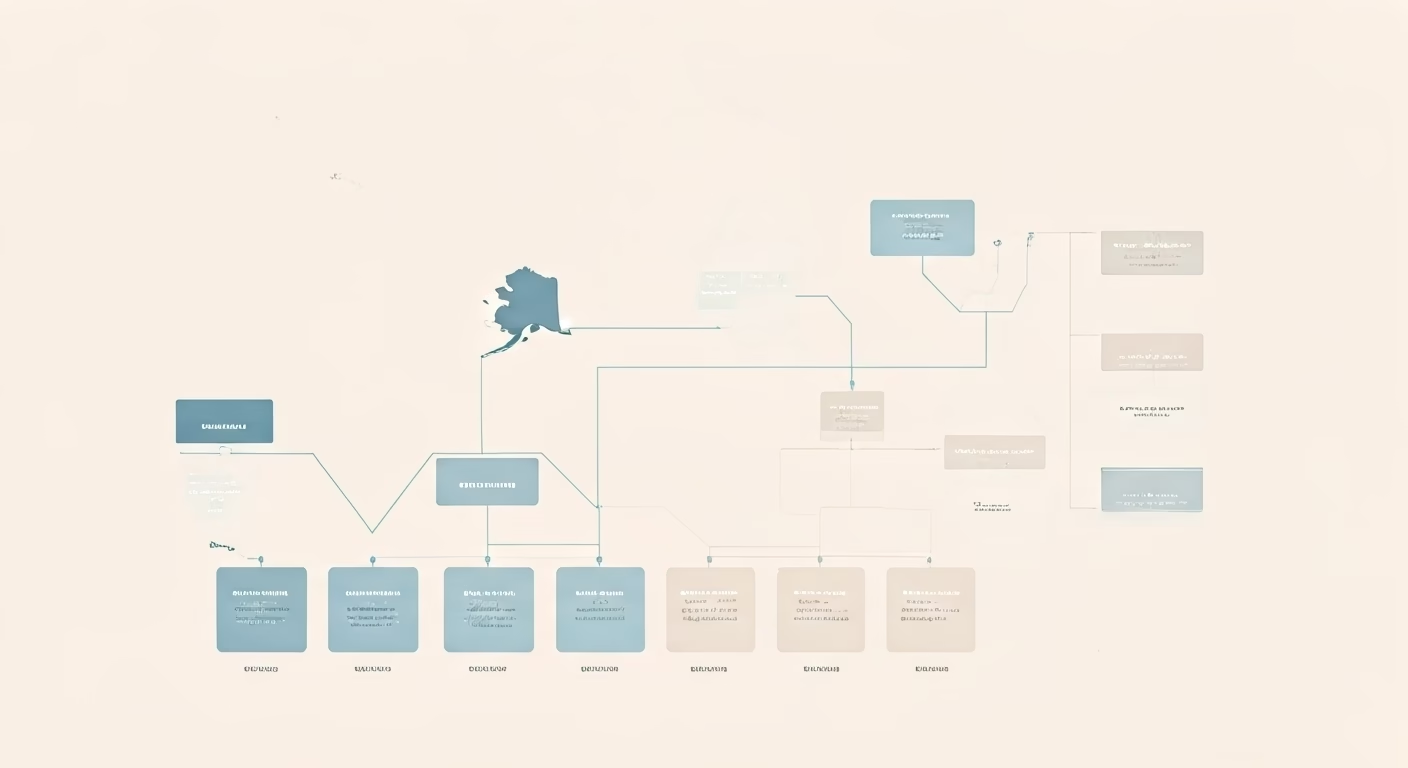

Expanding or starting a business in the United States is exciting—but one of the first and most important decisions you’ll make is choosing your business structure.

Your business structure determines how your company is taxed, how liability is handled, how you can raise capital, and even which visa options are available to you as a foreign entrepreneur. Choosing the wrong structure can create legal headaches, tax issues, and investor challenges down the line.

In this guide, we’ll break down the most common business structures for foreign entrepreneurs in the U.S., explain their pros and cons, and share real-life case studies so you can make an informed decision.

Why Your Business Structure Matters

Your business structure affects several critical aspects of running a U.S. company:

- Liability: Some structures protect your personal assets, while others expose them to risk.

- Taxes: Federal and state taxes differ depending on your structure.

- Investor appeal: Venture capital firms often prefer certain structures, such as Delaware C-Corps.

- Immigration: Some visas require a certain type of U.S. business entity.

Getting this decision right is the first step toward a successful U.S. business launch.

1. Limited Liability Company (LLC)

Key Features

- Protects your personal assets from business liabilities

- Flexible management structure

- Pass-through taxation (profits are taxed at the personal level)

- Relatively simple to set up and maintain

Best For

- Entrepreneurs seeking liability protection with minimal corporate formalities

- Businesses not immediately seeking venture capital

Case Study

A Kenyan entrepreneur opened a digital marketing firm in Georgia as an LLC. The flexibility allowed him to hire contractors and manage the business without strict corporate formalities. After three years, the business grew and attracted U.S. clients without requiring outside investment.

2. C-Corporation

Key Features

- Separate legal entity from owners

- Ability to raise capital through stock issuance

- Double taxation: profits are taxed at the corporate level, and dividends are taxed at the personal level

- Preferred by U.S. venture capitalists

Best For

- Startups seeking investment from U.S. venture capital firms

- Companies planning to issue stock or scale rapidly

Case Study

A Nigerian fintech startup registered as a Delaware C-Corp to attract U.S. investors. This structure allowed the company to offer equity to employees and raise $500,000 in seed funding within the first year.

3. S-Corporation

Key Features

- Pass-through taxation similar to an LLC

- Ownership restrictions: only U.S. citizens or residents can be shareholders

- Limited to 100 shareholders

Best For

- Small businesses with U.S. shareholders

- Companies seeking pass-through taxation while maintaining corporate formalities

Note: As a foreign entrepreneur, S-Corp is usually not an option unless you have U.S. partners.

4. Branch or Subsidiary

Key Features

- Branch: An extension of your foreign company operating in the U.S.

- Subsidiary: A separate U.S. company controlled by your foreign parent company

- Liability protection and compliance requirements vary

Best For

- Established international businesses expanding to the U.S.

- Companies transferring executives or specialized employees under L-1 visas

Case Study

A South African tech company opened a U.S. subsidiary in Delaware. This structure allowed the founder to transfer himself as CEO using the L-1 visa and hire local staff, while keeping the original company in South Africa operational.

5. Sole Proprietorship

Key Features

- Simplest structure with minimal registration requirements

- Owner personally liable for business debts

- Profits taxed as personal income

Best For

- Very small businesses with low risk

- Temporary U.S. operations or testing a business idea

Caution: This structure offers no liability protection and is rarely recommended for foreign entrepreneurs aiming to scale.

How to Decide the Right Structure

- Assess your liability risk: Do you need personal asset protection?

- Consider your tax situation: Double taxation may be acceptable if it means attracting investors.

- Plan for investors or funding: VCs usually require a C-Corp.

- Think about immigration goals: Certain visas (like L-1) work better with subsidiaries.

- Factor in long-term growth: Consider whether you’ll scale nationally or internationally.

Expert Tips for Foreign Entrepreneurs

- Delaware is a popular state for incorporation due to business-friendly laws and well-established courts.

- Always consult with a U.S. attorney or accountant to review your structure and tax obligations.

- Keep your business purpose and operations aligned with your visa and immigration goals.

Ready to Get Legally Ready?

Choosing the right U.S. business structure is just the beginning. To confidently navigate business registration, immigration, compliance, and funding, enroll in our e-course:

Legally Ready: Start Your Business in the United States as a Foreign Entrepreneur

With step-by-step guidance, checklists, and real-world examples, you’ll have everything you need to launch or expand your business in the U.S. without surprises.

Schedule a consultation to speak with a lawyer.